PhysicalPublicChain

Publique contenido y obtenga rendimientos de minería por contenido

placeholder

- Recompensa

- Me gusta

- 2

- Republicar

- Compartir

Junziyou1918 :

:

El momento en que se puede retirar lo que se mina en el teléfono es cuando colapsa.Ver más

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

El volumen gastado por los holders a corto plazo de $BTC en ganancias ha disminuido al 45%, por debajo del umbral neutral. Esto refleja un mercado equilibrado, con una toma de ganancias modesta y sin una clara convicción direccional entre los inversores a corto plazo.

#crypto#

Ver originales#crypto#

- Recompensa

- 1

- 4

- Republicar

- Compartir

SimpleHappiness1111 :

:

Envía un anuncio jajajajajajajajajajaja el propietario de manera exhaustiva y repetitiva.Ver más

A quién seguir

Más

YiboMarketAnalysis

¡Se puede luchar tanto en largo como en corto, solo el efectivo es seguro!

A4P-PRIYA✅

Usuario más activo

ZhongDaSaid

Usuario más activo

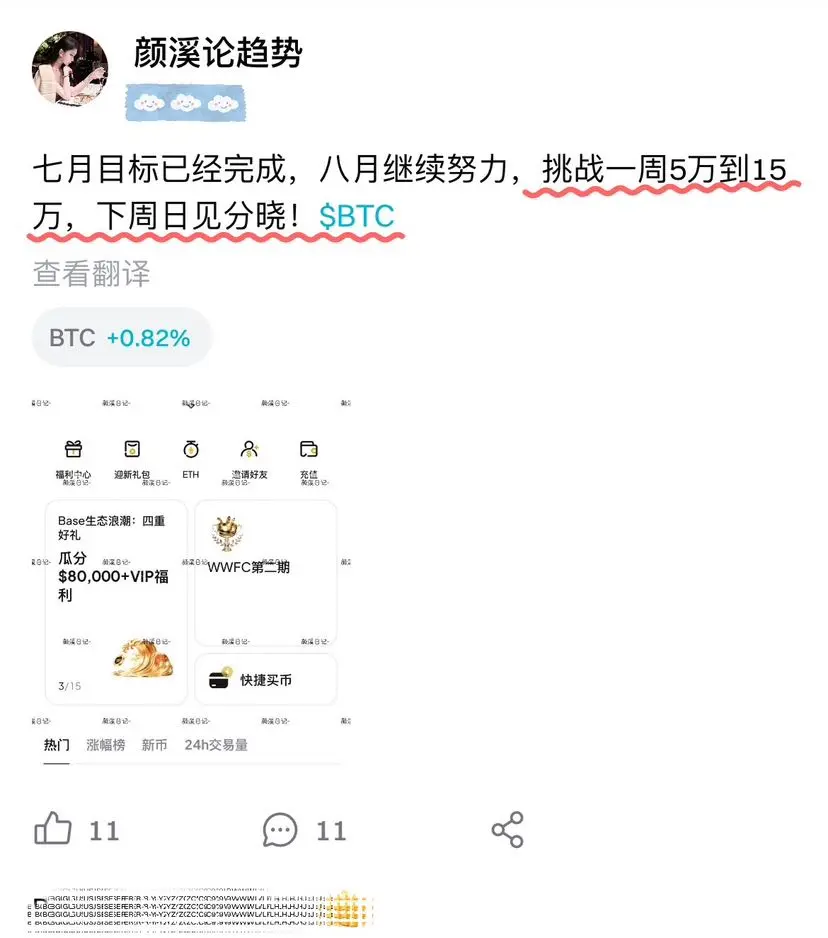

Analizo detenidamente $ETH, el actual precio de 3500 dólares parece común, pero esconde un profundo significado. La actividad on-chain está aumentando de manera constante, el ecosistema L2 está floreciendo y los fondos institucionales también están haciendo su movimiento en silencio.

$ETH como líder en contratos inteligentes, está avanzando hacia nuevas alturas en activos financieros. Un objetivo razonable para mí a fin de año son 7000 dólares, las fluctuaciones de precios no son más que brechas en la corrección del mercado. Ahora, elige posicionarte en momentos de bajo perfil y espera a que e

$ETH como líder en contratos inteligentes, está avanzando hacia nuevas alturas en activos financieros. Un objetivo razonable para mí a fin de año son 7000 dólares, las fluctuaciones de precios no son más que brechas en la corrección del mercado. Ahora, elige posicionarte en momentos de bajo perfil y espera a que e

ETH2.37%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

- Recompensa

- Me gusta

- 1

- Republicar

- Compartir

I_mGoingToSleepXMC :

:

DOGE es una basura, no tiene su propio mercado, solo sigue comiendo de las sobras de BTC y Ether, ni siquiera puede comer algo caliente.¡Cápsula de vela sexta Dan!

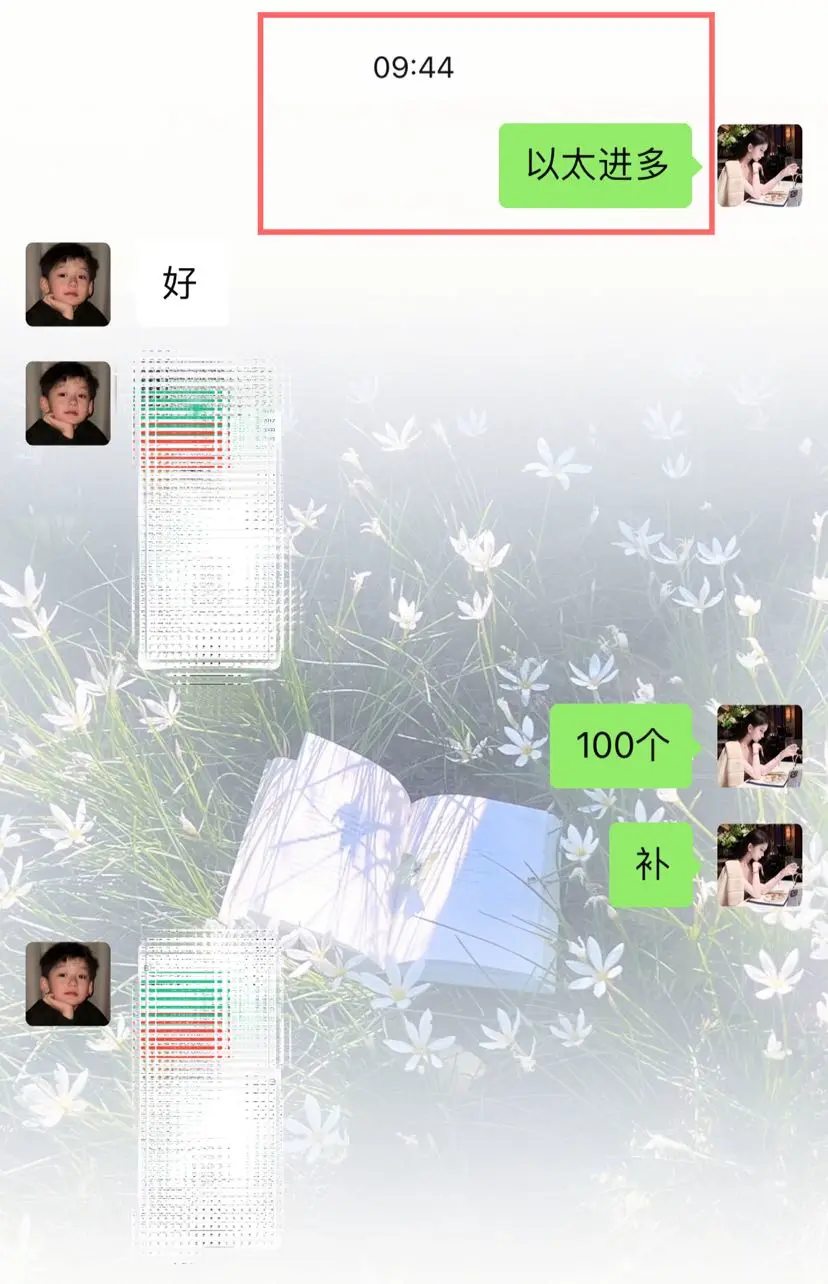

Esta mañana, el Ether estaba por encima de 3690, salió cerca de 3800, con un espacio de cerca de 110 puntos, 21000🔪!(Actualmente se han acumulado 15w🔪!)

Ver originalesEsta mañana, el Ether estaba por encima de 3690, salió cerca de 3800, con un espacio de cerca de 110 puntos, 21000🔪!(Actualmente se han acumulado 15w🔪!)

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Está bien, está bien, FB no es conveniente, ¿verdad?

FB-1.61%

[El usuario ha compartido sus datos de comercio. Vaya a la aplicación para ver más.]

SuperCryptoWorld,Let'sTest.

[El usuario ha compartido sus datos de comercio. Vaya a la aplicación para ver más.]

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

"Tokenización" es la mayor mentira en el fraude criptográfico.

Si las instituciones financieras realmente quisieran cambiar las reglas para permitir el acceso abierto, global y 24/7 a los mercados de acciones/commodities, lo harían. La "tokenización" no ofrece beneficios a las instituciones financieras ya que no quieren eliminar su poder monopólico.

Ver originalesSi las instituciones financieras realmente quisieran cambiar las reglas para permitir el acceso abierto, global y 24/7 a los mercados de acciones/commodities, lo harían. La "tokenización" no ofrece beneficios a las instituciones financieras ya que no quieren eliminar su poder monopólico.

- Recompensa

- 1

- 2

- Republicar

- Compartir

MarketLady :

:

Buena informaciónVer más

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

#ETH Whales Accumulate# Vamos a esperar la gran subida que se está acercando #Show My Alpha Points# #Gate & WLFI USD1 Points Program # #Show My Alpha Points# #ETH Whales Accumulate#

Ver originales

- Recompensa

- Me gusta

- 1

- Republicar

- Compartir

Muazzzzz :

:

HODL Tight 💪- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

El Banco de Inglaterra recortó las tasas de interés, con el gobernador Andrew Bailey y cuatro colegas apoyando la reducción de las tasas al 4%, mientras que otros cuatro responsables políticos buscaron mantener los costos de los préstamos en hold debido a preocupaciones sobre la alta inflación.

HOLD1.23%

- Recompensa

- 13

- 4

- Republicar

- Compartir

LayerHopper :

:

¿Esta ronda de salvamento podrá contener la inflación? JejeVer más

- Recompensa

- Me gusta

- 3

- Republicar

- Compartir

HSKMustHoldFirmly :

:

Estás hablando tonterías.Ver más

- Recompensa

- 2

- 13

- Republicar

- Compartir

AllIn,JustDoIt :

:

¡Tonto! ¡Comparar esta moneda de bomba con XRP! Piensa en lo gracioso.Ver más

Si quieres ir rápido, ve solo

Si quieres llegar lejos, ve acompañado

Este es el camino

Si quieres llegar lejos, ve acompañado

Este es el camino

FAST-0.09%

- Recompensa

- 7

- 4

- Republicar

- Compartir

MetaMisery :

:

No se trata de qué tan lejos se va, sino de si se quiere acompañar.Ver más

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

Cargar más

Únete a 30 millones de usuarios en nuestra creciente comunidad

⚡️ Únete a 30 millones de usuarios en la conversación sobre la tendencia cripto

💬 Interactúa con tus creadores favoritos

👍 Explora lo que te interesa

- Tema

27k Popularidad

8k Popularidad

2k Popularidad

77k Popularidad

21k Popularidad

A quién seguir

Más

YiboMarketAnalysis

¡Se puede luchar tanto en largo como en corto, solo el efectivo es seguro!

A4P-PRIYA✅

Usuario más activo

ZhongDaSaid

Usuario más activo

VirtualCurrencyResearc

Usuario más activo

2024BigNiuNiu

Usuario más activo

Sin registro

- Anclado