Ondo Token Price Surges Past $1 as Robinhood Officially Lists ONDO

Robinhood Officially Launches ONDO Trading

Robinhood, the leading platform for U.S. stocks and cryptocurrency trading, has officially added Ondo Finance (ONDO) to its tradable assets today. The platform also enabled trading for users in the European Union. With ONDO now available on a mainstream investment platform, its market acceptance and liquidity are poised for a substantial boost.

Immediate Market Reaction

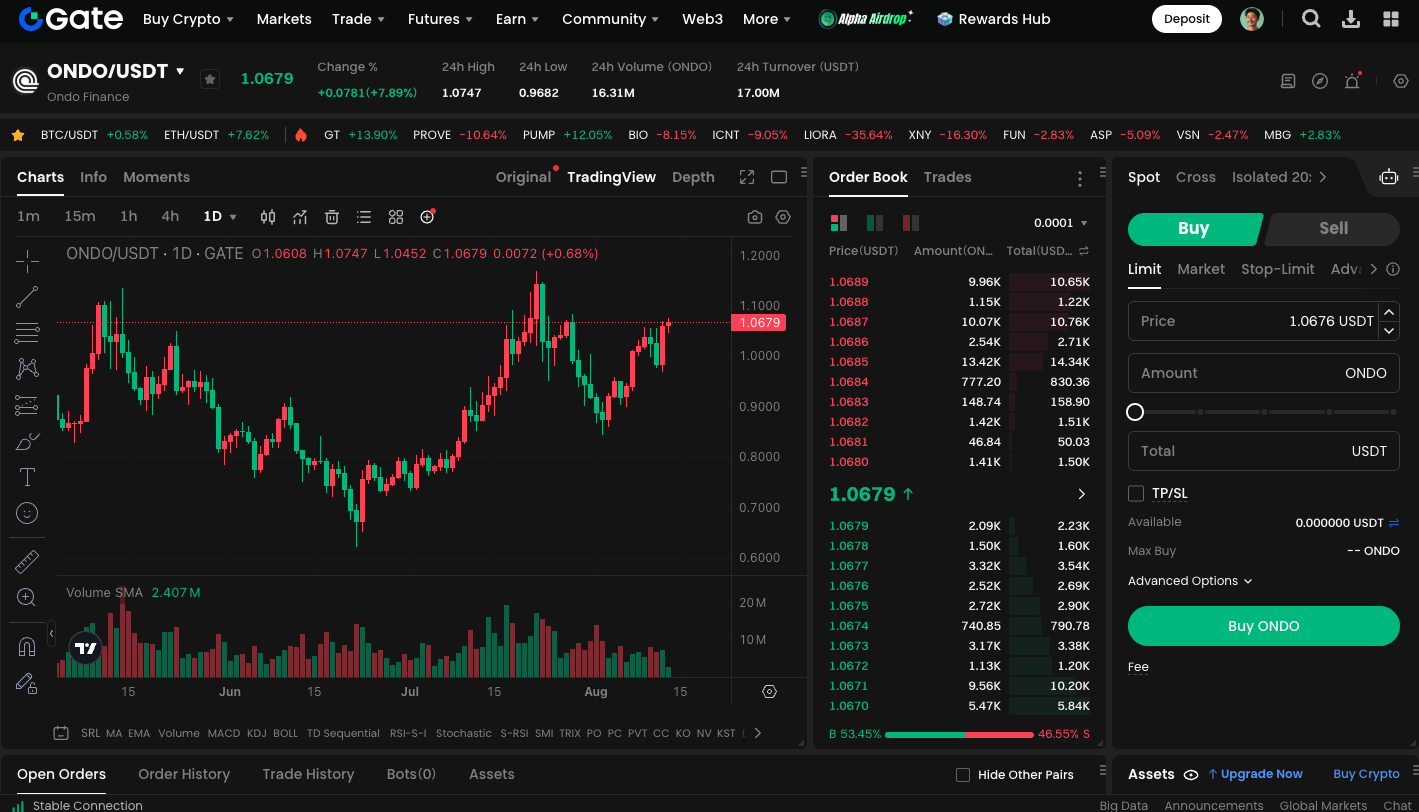

Following the listing announcement, ONDO’s token price quickly surged past the $1 threshold. Daily trading volume spiked above $180 million. The Korean won pair continues to represent a significant share—highlighting strong demand for ONDO across Asian markets.

Ondo Finance’s Industry Position

Ondo Finance is focused on tokenization solutions for real-world assets (RWA) and maintains active partnerships with leading financial institutions. The company provides tokenization services for U.S. Treasury securities issued by Franklin Templeton and Wisdom Tree. ONDO’s launch on Robinhood is expected to further enhance its retail market presence and increase capital flows within its broader ecosystem.

Technical Analysis and Price Outlook

Technically, ONDO traded in a range between $0.8 and $1 for an extended period. This breakout above $1 may signal the beginning of a new upward trend. If ONDO maintains levels above $1.16, it may test the $2.1 mark by year-end; conversely, if it drops below $0.8, support levels may shift down to $0.76 or even $0.6.

Key Reasons to Watch ONDO

Analysts generally attribute ONDO’s upward momentum to two primary drivers:

- Support from mainstream platforms is fueling ONDO’s growth in both liquidity and user base, with simultaneous support from institutional and retail investors.

- Long-term growth potential in the RWA sector — As tokenization of traditional financial assets accelerates, ONDO is reinforcing its position as a core infrastructure provider.

With Robinhood’s support, ONDO’s token price is likely to see short-term gains driven by both fresh capital and positive market sentiment.

Trade ONDO spot instantly: https://www.gate.com/trade/ONDO_USDT

Summary

Robinhood’s official launch of Ondo Finance (ONDO) trading not only increases the ONDO token’s visibility and liquidity, but also provides investors with broader access to this innovative project. As an early mover in the tokenization of real-world assets (RWA), Ondo Finance has formed strategic partnerships with major financial institutions, and its technology and applications have received broad industry recognition.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025