- Topic

14k Popularity

8k Popularity

5k Popularity

82k Popularity

2k Popularity

- Pin

- 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re - 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win. - 📢 Gate Square Exclusive: #WXTM Creative Contest# Is Now Live!

Celebrate CandyDrop Round 59 featuring MinoTari (WXTM) — compete for a 70,000 WXTM prize pool!

🎯 About MinoTari (WXTM)

Tari is a Rust-based blockchain protocol centered around digital assets.

It empowers creators to build new types of digital experiences and narratives.

With Tari, digitally scarce assets—like collectibles or in-game items—unlock new business opportunities for creators.

🎨 Event Period:

Aug 7, 2025, 09:00 – Aug 12, 2025, 16:00 (UTC)

📌 How to Participate:

Post original content on Gate Square related to WXTM or its

The Nikkei average of 40,000 yen is somewhat overbought from a fundamental perspective; an improvement in earnings momentum is necessary for further upward movement | Strategy Report | Moneyクリ MoneyCris Securities' investment information and media useful for money

Factors That Avoided the Reappearance of Black Monday in the Reiwa Era

The Tokyo stock market was hit hard at the beginning of the week. The U.S. employment statistics released at the end of the previous week were weaker than market expectations, raising concerns about a slowdown in the U.S. economy, which led to a decline in U.S. stock prices. This trend resulted in broad selling across various stocks in the Tokyo market. At one point, the Nikkei average fell by more than 900 yen, dipping below the psychological level of 40,000.

Many market participants may have been reminded of the "return of Reiwa's Black Monday," as the Nikkei Average recorded a decline of 4,451 yen, the largest drop in history. The Reiwa Black Monday occurred exactly one year ago on August 5, 2024. This was right after the Bank of Japan's monetary policy meeting at the end of July, and the fact that the U.S. employment statistics released on August 2 were weak, leading to a sharp drop in stock prices, is exactly the same.

However, the Japanese stock market in 2025 has developed differently compared to last year. After the selling pressure subsided, buying on dips emerged, leading to a modest decline. The Nikkei average's closing price fell by 508 yen or just over 1% compared to the previous weekend, maintaining a closing price above the significant 40,000 yen mark.

This time, there are several factors that allowed Japanese stocks to withstand the shock of the U.S. employment statistics and avoid a repeat of the Heisei Black Monday, but the most obvious is the stance of the Bank of Japan.

Looking back at last year, on July 31, 2024, the Bank of Japan raised the policy interest rate from 0 to 0.10% to 0.25%. One of the reasons for the increase was to suppress price rises caused by the depreciation of the yen. Furthermore, Bank of Japan Governor Kazuo Ueda suggested that if the economy and prices continue to progress as expected, they would continue to raise interest rates.

In contrast, this year presents a situation that can be described as completely opposite. The Bank of Japan decided to maintain the current policy interest rate at its meeting. Following this, in a press conference, Governor Ueda stated, "We do not see any immediate significant impact on the inflation outlook," which triggered a further depreciation of the yen. The market interpreted this as the Bank of Japan adopting a dovish stance that is not in a hurry to raise rates.

Due to the Bank of Japan's stance, the 10-year bond yield, which temporarily exceeded 1.6%, has now decreased to below 1.5%. This is believed to be supporting Japanese stocks.

The surge following the conclusion of tariff negotiations is excessive.

The Nikkei Average is maintaining the 40,000 level, which is quite impressive. This is because the surge following the conclusion of tariff negotiations can be likened to a "buffer," and the subsequent correction is merely a result of releasing the overshoot.

The surge following the conclusion of tariff negotiations seems excessive. The Japan-U.S. trade negotiations took a sudden turn and concluded on July 23. Not only did the initially proposed mutual tariff rate drop to 15%, but there was also an agreement to set the automobile tariff rate at 15% in conjunction with the existing tariff rates. It is not an exaggeration to say that the market reacted with wild enthusiasm. The Nikkei average rose by over 1500 yen at one point, and Toyota's stock price surged by as much as 16%. The optimistic mood continued on the following day, the 24th, with the Nikkei average significantly extending its gains, and during trading hours, there was a moment when it touched 42,000 yen. The TOPIX updated its highest value in a year.

However, as mentioned earlier, this is clearly an overshoot. This is because, although the tariff rates have indeed decreased, tariffs are still imposed. The negative factors affecting the economy and corporate performance have not disappeared.

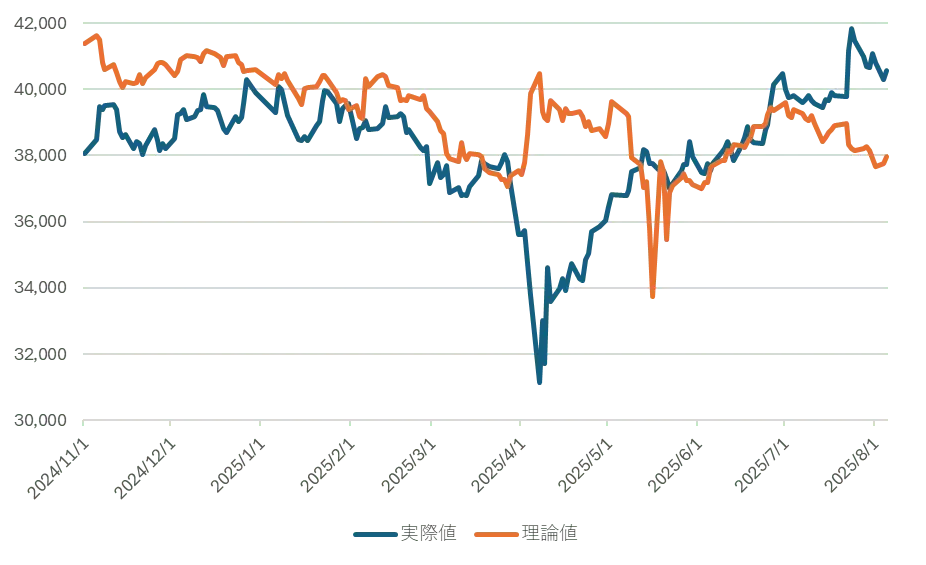

And the crucial fundamentals are deteriorating. Graph 1 shows the theoretical stock price calculated by the author and the actual Nikkei average, and it can be seen that the divergence from the theoretical stock price has widened recently.

[Graph 1] Transition of Theoretical Stock Price and Nikkei Average Stock Price Source: Created by the author based on QUICK data

The theoretical stock price is calculated based on the company's performance outlook and long-term interest rates. As mentioned earlier, the decline in interest rates is a positive factor for stock prices, but the performance outlook has also deteriorated. As a result, the theoretical stock price of the Nikkei average is currently around 38,000 yen. Of course, in the actual market, stock prices do not always align with theoretical values, so it is possible to see prices in the 40,000 yen range as we do now. However, from the perspective of fundamentals such as performance and interest rates, this indicates that the market may be somewhat overbought.

Source: Created by the author based on QUICK data

The theoretical stock price is calculated based on the company's performance outlook and long-term interest rates. As mentioned earlier, the decline in interest rates is a positive factor for stock prices, but the performance outlook has also deteriorated. As a result, the theoretical stock price of the Nikkei average is currently around 38,000 yen. Of course, in the actual market, stock prices do not always align with theoretical values, so it is possible to see prices in the 40,000 yen range as we do now. However, from the perspective of fundamentals such as performance and interest rates, this indicates that the market may be somewhat overbought.

[Graph 2] Trends of 10-Year Bond Yields and EPS (Earnings Per Share) Source: Created by the author based on QUICK data

The market has started with a turbulent August, but from now on, market participants will gradually leave the market for summer vacations, and the summer doldrums will begin to set in. After passing through important events such as the House of Councillors election, the conclusion of tariff negotiations, the FOMC (Federal Open Market Committee), the Bank of Japan meeting, and the U.S. employment statistics, the market is somewhat drifting in a sense of "post-festival" fatigue. In this context, the focus is on whether foreign buying will continue.

Source: Created by the author based on QUICK data

The market has started with a turbulent August, but from now on, market participants will gradually leave the market for summer vacations, and the summer doldrums will begin to set in. After passing through important events such as the House of Councillors election, the conclusion of tariff negotiations, the FOMC (Federal Open Market Committee), the Bank of Japan meeting, and the U.S. employment statistics, the market is somewhat drifting in a sense of "post-festival" fatigue. In this context, the focus is on whether foreign buying will continue.

According to the stock trading trends by investment sector (total of TSE and Nagoya Stock Exchange) announced by the Tokyo Stock Exchange on July 31 for the fourth week of July (22-25), foreign investors had a net purchase of 602.3 billion yen in the fourth week of July. This marks 17 consecutive weeks of net buying, with the cumulative amount exceeding 6 trillion yen during this period. The duration of net buying by foreign investors is approaching the 18 consecutive weeks seen in the early stages of Abenomics starting from November 2012. However, when looking at the monthly foreign investor trading data, there is evidence that August has often seen net selling. If the record foreign net buying were to come to an end, as mentioned earlier, the Nikkei average could be considered somewhat overbought from a fundamental perspective, so it would be wise to keep in mind the risk of short-term adjustments.

Attention to Toyota's earnings report to be announced on the 7th.

In the previous section, I mentioned that the performance momentum of Japanese companies is downward as they approach the first quarter earnings announcements. Amidst this, attention is focused on the automotive sector, particularly the performance of Toyota Motor Corporation (7203), which will announce its earnings on the 7th. While the impact of tariffs is a concern, simply put, the performance is good. The new vehicle sales figures for July in the United States were recently released, and Toyota saw an increase of about 20%. Furthermore, even with price increases, sales have not declined. For this reason, it has been reported that Toyota communicated its plan to major parts manufacturers to achieve a global production volume of approximately 10 million units by 2025. As mentioned above, due to strong sales, this figure is slightly higher than the initial plan set at the beginning of the year (about 9.9 million units), and if realized, it would approach the record high achieved in 2023 (10.03 million units). With significant fluctuations in the exchange rate, expectations for Toyota's upward revision are rising.

As for the exchange rate, it had been a depreciation of the yen until it reversed to a weaker dollar and stronger yen with the employment statistics. The background was the hawkish stance of the Federal Reserve (FRB).

At the FOMC meeting on July 30, a decision was made to keep the policy interest rate unchanged for the fifth consecutive meeting. Vice Chair of Supervision Bowman and Governor Waller voted against the reduction, calling for a 0.25% cut. The opposition of these two governors, the first in 32 years, attracted attention, but both are figures associated with President Trump, making their dissent expected. More importantly, despite the significant pressure from President Trump’s demands for a rate cut, the market perceived Chairman Powell's stance as hawkish. Chairman Powell did not make particularly hawkish comments. His stance on inflation remained consistent with previous positions. Nonetheless, the market may have had some expectation that there would be a degree of consideration for Trump's demands, and the currency market responded to Chairman Powell's outright rejection of such speculation with a stronger dollar.

At that point, the market view leaned towards the possibility that there might not be any interest rate cuts for the time being, but the employment statistics completely changed the market mood. Dark clouds began to gather regarding the outlook for the U.S. economy, and in the U.S. bond market, the yield on the 2-year bonds, which are sensitive to monetary policy, suddenly dropped to 3.66%, 0.29% lower than the previous day. The previously withdrawn expectation of a rate cut by the Fed is now being rapidly priced in.

The Fed's interest rate cuts are a tailwind for U.S. stocks, but if this leads to a stronger yen, it will be a burden for Japanese stocks. However, I believe the yen will not strengthen that much. Although the direction of monetary policy in Japan and the U.S. is opposite, the pace of interest rate cuts and hikes is not expected to be that fast. Another reason is the investments promised to the U.S. as part of trade negotiations. Japan has committed to an investment of $550 billion. Following that, South Korea has promised an investment of $350 billion. Together, these will result in a total of $900 billion in investments to be executed in the future. This breakdown is divided into "investments," "loans," and "loan guarantees," and it is believed that the loan portion is substantial, although the full details are not yet known. In any case, there is no doubt that there will be a huge demand for dollar funding, which may have contributed to the recent strength of the dollar. This scenario is likely a factor for a stronger dollar that has not yet been fully priced into the market.